Debt settlement is a process in which the different loan granting agencies settle on a percentage of the loan instead of the full amount. The loan settlement takes when it becomes crystal clear to the creditor that he will not be able to receive the full amount he owes because the borrower is not in the position to pay back the full amount and he can only pay the partial amount.

The creditor can think of getting the partial amount since getting something is better than nothing. This type of settlement also applies to auto loans.

It is a letter in which the creditor communicates his willingness for settlement. There is a rule in different states that allow people to settle even for auto-related debt. Make sure that when you write this letter, you are clear and concise. In some cases, the debtor also writes this letter to let the reader know what he can pay and how he wants to settle.

Some basic steps that can be taken to write a professional letter are:

Start with giving the background information:

When you start this letter, let the creditor know that you have been going through an intense financial crisis and this was the reason, you have not paid the auto loan for a long time. Make it clear to the reader that you have some financial setbacks that have held you back from paying the loan.

Mention your current financial situation:

Tell the reader what your account balance is. Also, specify how much you are supposed to be paying. You need to explain this in such a way that it gets clear to the debtor that you are not going to pay the auto loan and therefore you need to settle down.

Write what you can pay:

Also, tell the reader how much you can easily pay and when. If you have mentioned the clear amount, make sure that you don’t forget to tell whether it includes taxes amount and late payment fee so that the reader can know if you are going to pay them separately or not.

End the letter:

As you are moving forward towards the end of the letter, here is the time to ask the reader to contact you if he agrees with your settlement plan. Provide your contact details and specify that you will be thankful to him for being generous.

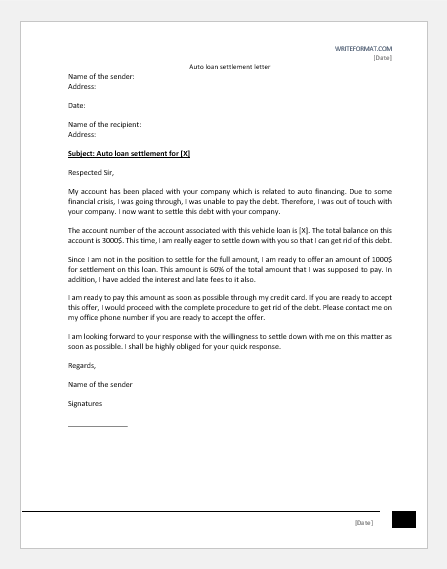

The sample letter given below will help you write a settlement letter to the creditor to let him know that you cannot pay the full amount but the partial amount.

Sample letter:

My account has been placed with your company which is related to auto financing. Due to some financial crisis, I was going through, I was unable to pay the debt. Therefore, I was out of touch with your company. I now want to settle this debt with your company.

The account number of the account associated with this vehicle loan is [X]. The total balance on this account is 3000$. This time, I am really eager to settle down with you so that I can get rid of this debt.

Since I am not in the position to settle for the full amount, I am ready to offer an amount of 1000$ for settlement on this loan. This amount is 60% of the total amount that I was supposed to pay. In addition, I have added the interest and late fees to it also.

I am ready to pay this amount as soon as possible through my credit card. If you are ready to accept this offer, I would proceed with the complete procedure to get rid of the debt. Please contact me on my office phone number if you are ready to accept the offer.

I am looking forward to your response with the willingness to settle down with me on this matter as soon as possible. I shall be highly obliged for your quick response.

- Apology Letter after Resignation

- Apology Letter for Late Submission of Assignment

- Letter of Intent to Run for HOA Board

- Excuse Letter of Absence due to Family Together

- Authorization Letter for Salary Deduction

- Excuse Letter for Being Absent from Work due to Wedding

- Excuse Letter for Being Late to School for Late Wakeup

- Hostile Work Environment Complaint Letter to Boss

- Acknowledgment Letter for Lending Money

- Greeting Email (letter) to New Business Partner